Understanding Flood Insurance: A Comprehensive Guide

Flood insurance is a type of property insurance that specifically covers losses and damage caused by flooding. This guide explains what flood insurance is, why it’s important, and how you can obtain it.

What is Flood Insurance?

Flood insurance provides financial protection against damage to your property and belongings due to flooding. Unlike standard homeowners insurance policies, which typically do not cover flood damage, flood insurance is designed to cover such losses. It can be purchased by homeowners, renters, and businesses.

Importance of Flood Insurance

-

Natural Disasters: Floods are among the most common natural disasters and can occur anywhere. They can result from heavy rain, hurricanes, storm surges, melting snow, and other events.

-

Financial Protection: Flood damage can be extensive and costly. Without flood insurance, you may have to pay out-of-pocket for repairs and replacements.

-

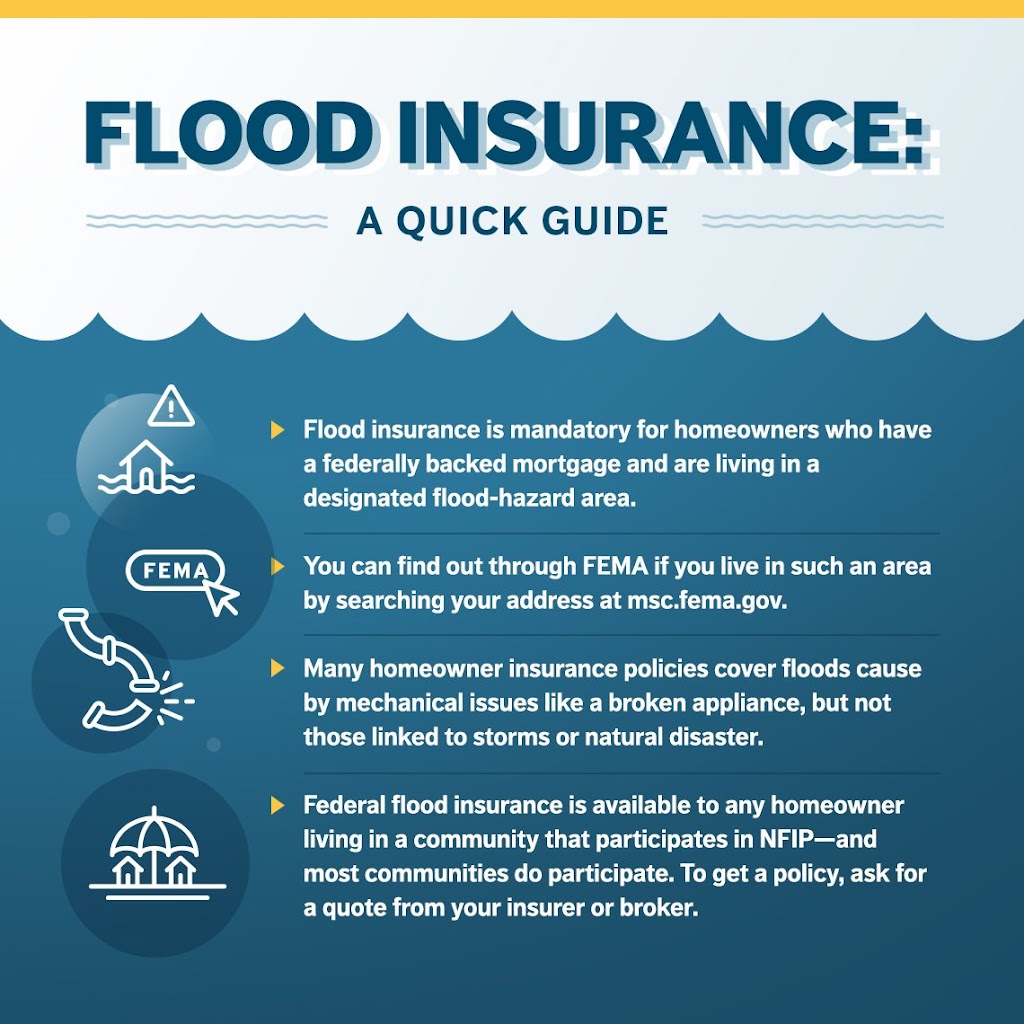

Mortgage Requirement: If you live in a high-risk flood area, your mortgage lender may require you to have flood insurance.

-

Peace of Mind: Knowing you have coverage in place can provide peace of mind, especially during storm seasons.

How to Get Flood Insurance

-

Determine Your Risk: Check if you live in a flood-prone area. You can use resources like the Federal Emergency Management Agency (FEMA) Flood Map Service Center to find your property’s flood zone. Knowing your risk level will help you understand the necessity and cost of flood insurance.

-

Contact Your Insurance Agent: Reach out to your current insurance agent or company to inquire about flood insurance. They can provide information on policies and help you determine the right coverage for your needs.

-

National Flood Insurance Program (NFIP): The NFIP, managed by FEMA, is the primary source of flood insurance in the U.S. You can purchase an NFIP policy through insurance companies and agents that participate in the program. The NFIP offers coverage for:

- Building Property: Covers the physical structure of your home or business.

- Personal Property: Covers personal belongings inside the building.

-

Private Flood Insurance: In addition to NFIP policies, private insurers also offer flood insurance. Private flood insurance can sometimes provide higher coverage limits and additional options not available through the NFIP.

-

Compare Policies: Compare different flood insurance policies to find the best coverage and rates. Consider factors such as coverage limits, deductibles, exclusions, and premium costs.

-

Purchase the Policy: Once you’ve chosen a policy, complete the application process and purchase the flood insurance. Keep in mind that NFIP policies typically have a 30-day waiting period before coverage takes effect, so plan ahead.

-

Review and Update: Review your flood insurance policy annually and update it as needed, especially if you make significant improvements to your property or if there are changes in flood risk levels in your area.

What Does Flood Insurance Cover?

Flood insurance generally covers two types of property:

-

Building Property Coverage:

- Structural elements like walls, floors, electrical and plumbing systems.

- Built-in appliances such as refrigerators, stoves, and dishwashers.

- Permanently installed carpeting over an unfinished floor.

-

Personal Property Coverage:

- Personal belongings like furniture, clothing, and electronics.

- Portable appliances like washers and dryers.

- Certain valuable items such as artwork and furs (usually up to a specified limit).

What’s Not Covered?

- Damage caused by moisture, mildew, or mold that could have been avoided.

- Temporary housing and additional living expenses.

- Vehicles and outdoor property such as pools and landscaping.

- Financial losses caused by business interruption or loss of use of insured property.

Conclusion

Flood insurance is an essential coverage for those living in flood-prone areas, providing financial protection and peace of mind against the devastating effects of flooding. By understanding your risk, exploring available options, and carefully selecting the right policy, you can ensure that you are adequately protected in the event of a flood.To obtain flood insurance, you can follow these steps:

-

Assess Your Flood Risk: Determine your property’s flood risk by checking flood maps provided by FEMA or consulting with local authorities. Understanding your risk level will help you determine the necessity and cost of flood insurance.

-

Contact Your Insurance Agent: Reach out to your current insurance agent or company to inquire about flood insurance options. They can provide information on available policies and help you understand the coverage options and costs.

-

Explore the National Flood Insurance Program (NFIP):

- The NFIP, managed by FEMA, offers flood insurance policies to property owners, renters, and businesses in participating communities across the United States.

- Visit the NFIP website or call their toll-free number to find an insurance agent who sells NFIP policies in your area.

-

Consider Private Flood Insurance:

- In addition to NFIP policies, private insurance companies also offer flood insurance coverage. Private flood insurance may provide higher coverage limits and additional options not available through the NFIP.

- Contact private insurance companies or insurance brokers who specialize in flood insurance to inquire about policies and compare coverage options.

-

Gather Necessary Information:

- Before purchasing flood insurance, gather relevant information about your property, including its location, construction details, and value of contents. This information will help insurance agents determine the appropriate coverage for your needs.

-

Review Policy Options:

- Review the flood insurance policy options provided by insurance agents or companies, considering factors such as coverage limits, deductibles, exclusions, and premium costs.

- Compare policies from different providers to find the best coverage and rates for your situation.

-

Purchase the Policy:

- Once you’ve selected a flood insurance policy that meets your needs, complete the application process and purchase the policy.

- Keep in mind that NFIP policies typically have a 30-day waiting period before coverage takes effect, so plan ahead and purchase the policy well in advance of any potential flooding events.

-

Review and Update Annually:

- Review your flood insurance policy annually and update it as needed, especially if there are changes to your property or flood risk levels in your area.

- Stay informed about any changes to flood insurance regulations or coverage options that may affect your policy.

By following these steps, you can obtain flood insurance to protect your property and belongings against the financial impact of flooding.